TransUnion: Credit Monitoring

TransUnion: Credit Monitoring App Info

-

App Name

TransUnion: Credit Monitoring

-

Price

Free

-

Developer

TransUnion Interactive, Inc.

-

Category

Finance -

Updated

2025-11-25

-

Version

5.5.0

TransUnion: Credit Monitoring — Your Personal Financial Bodyguard

In a world where your financial health is increasingly critical, TransUnion's Credit Monitoring app positions itself as a vigilant guardian—keeping an eye on your credit profile and alerting you to potential issues before they escalate. Developed by the well-established TransUnion team, this app combines accessibility with powerful features, aimed at consumers who want proactive control over their credit standing without drowning in complex data.

A Closer Look at What Makes It Stand Out

At its core, TransUnion Credit Monitoring offers real-time credit alerts, comprehensive report access, and credit score tracking—all wrapped in a user-friendly interface. Whether you're a first-time credit user or someone actively managing multiple financial accounts, this app strives to be your trusty sidekick in maintaining financial transparency and security.

Core Features That Pack a Punch

First and foremost, the app's **Real-Time Credit Alerts** are a game-changer. Imagine having a financial security guard standing just a tap away, notifying you instantly if suspicious activities or changes occur in your credit report. This proactive alert system helps in catching identity theft early, much like a security camera guarding your house.

Secondly, its **Detailed Credit Reports and Scores** provide users with an in-depth look at their credit health. Unlike many competitors that only provide a snapshot, TransUnion allows you to dive into the specifics — such as recent inquiries, account status, and historical trends — helping you understand what factors influence your score the most.

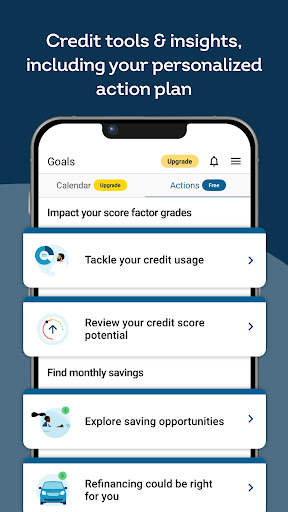

Thirdly, the app offers **Credit Education Resources** that demystify credit scores and financial planning. It's like having a friendly financial advisor in your pocket, guiding you through improving your credit profile with personalized tips and insights.

Design and User Experience — Friendly, Smooth, Intuitive

The app boasts a clean, modern interface that's designed with user comfort in mind. It's akin to browsing through a well-organized library—everything you need is logically categorized and easy to access. Navigation feels seamless, with smooth transitions that keep users immersed without frustration. The setup process is straightforward, making it accessible even for first-time users who might be wary of complicated financial apps.

Learning curve? Minimal. The app's onboarding walkthrough explains essential features clearly, and regular updates enhance stability and performance. The real-time notification system is prompt, ensuring you're never left in the dark when your credit profile changes—much like receiving a timely weather alert before a storm.

Distinctive Benefits Against Competitors

While many credit monitoring apps focus solely on displaying scores and reports, TransUnion puts a spotlight on **Account and Fund Security**. Its robust fraud detection mechanisms and immediate alerts to unauthorized activities make it a standout. For example, if someone attempts a fraudulent inquiry or opens an account in your name, you'll be notified instantly, giving you a head start to act.

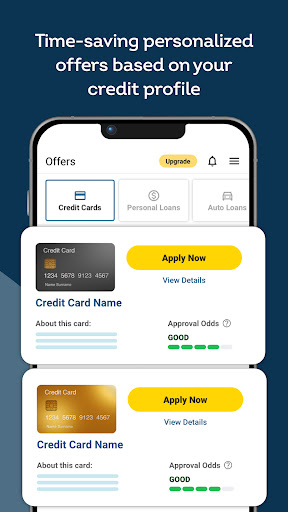

Furthermore, in terms of **Transaction Experience**, the app integrates smoothly with other financial tools and banks, providing a consolidated view of your credit health rather than isolated snapshots. This interconnectedness allows users to see the bigger picture—like viewing all the puzzle pieces simultaneously rather than individually—giving a sense of control and clarity that's rare among competitors.

Should You Give It a Try?

Based on its comprehensive features, intuitive design, and focus on security, I'd rate TransUnion Credit Monitoring as a highly recommended tool for anyone serious about maintaining their financial integrity. It's particularly suitable for users who want early warnings about suspicious activity and a clear understanding of their credit status without getting lost in technical jargon.

If you're someone who appreciates proactive monitoring, value transparency, and prefer a straightforward user experience, this app deserves a place on your mobile device. For those already managing multiple credit sources or striving to improve their scores, the educational resources and detailed reports will be especially helpful. However, if you're seeking a more holistic financial management platform that covers budgeting or investments, you might view this as a specialized app that's best complemented with others.

Overall, TransUnion's Credit Monitoring isn't just another app—it's a reliable financial companion designed to give you peace of mind and control over your credit health. Like having a trusted friend who's always watching out for your financial well-being, it's a practical choice for everyday protection and learning.

Pros

Comprehensive Credit Monitoring

Provides real-time updates on credit score changes and new account activity, helping users stay informed.

User-Friendly Interface

The app features an intuitive design that makes navigating and understanding credit reports straightforward.

Fraud Alert Integration

Includes alert features that notify users of suspicious activity or potential identity theft.

Educational Resources

Offers helpful tips and explanations about credit scores, improving financial literacy.

Multiple Credit Report Sources

Allows access to reports from all three major credit bureaus for a comprehensive view.

Cons

Limited Free Tracking (impact: medium)

Free tier only offers basic credit monitoring; full features require a paid subscription.

Delayed Credit Updates (impact: medium)

Some users have noted that credit report updates can lag by a few days, which might delay important alerts.

Notification Overload (impact: low)

Frequent alerts can sometimes overwhelm users, causing important notifications to be overlooked.

Limited Customization (impact: low)

Users seeking personalized monitoring settings may find the app's options somewhat restrictive.

Customer Support Accessibility (impact: low)

Support response times can be slow during peak periods, though official plans aim to improve this.

TransUnion: Credit Monitoring

Version 5.5.0 Updated 2025-11-25